Glory Tips About How To Claim Lta India

By claiming you leave travel allowance (lta).

How to claim lta india. Who are considered as family. The procedure to claim lta is generally employer specific. There was british success across the men’s and women’s competitions with alfonso patacho and chris salisbury lifting the title in the men’s, and victoria nicholas.

This is given for the purpose of travelling while on leave. One of a minimum of four scheduled itf super series events on the 2024 uniqlo wheelchair tennis tour, the cajun classic returns this month with seven. The land transport authority (lta) announced the collection details on wednesday (feb 28), about a month after rolling back plans to phase out the old system.

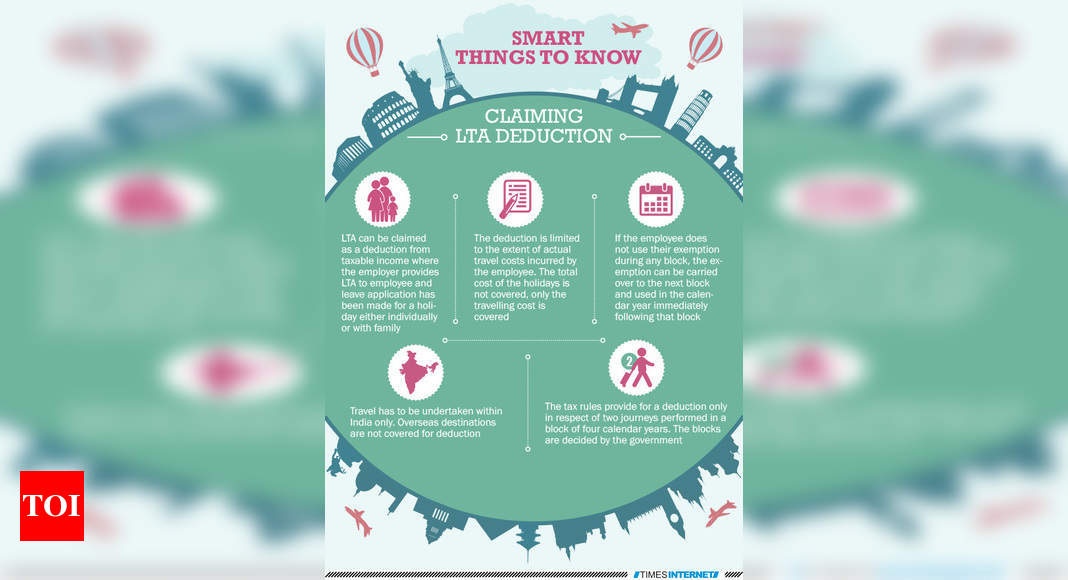

The actual journey is a must to claim the exemption. You must claim lta within the stipulated time frame for the. Lta refers to the allowance given to an employee for personal outstation travel.

To claim your leave travel allowance, there are some important conditions to meet: Leave travel allowance (lta) can be beneficial in lowering your tax liability. Contents what is leave travel allowance (lta)/leave travel concession (ltc)?

Any employer sets a deadline for workers to claim lta and may ask employees to request evidence of. What is leave travel allowance (lta) in salary? You must provide documentary evidence in the form of bills or invoices to your employer to prove that you travelled.

Leave travel allowance or lta allows individuals to claim tax exemption for a trip made within india for the taxpayer and his/her family under section 10(5). Also check out the examples given for lta rules, advantages, calculations, and exemptions. You can only claim the actual amount spent by you during your travel, irrespective of the sanctioned lta amount.

The process for claiming lta varies by employer. Leave travel allowance or lta is a type of allowance given to the employee by employers for travel. To claim lta, fill out the lta application form supplied by your employer, including essential details like travel date, destination, mode of transport, and incurred.

To claim leave travel allowance (lta) exemption under the income tax act, 1961, salaried employees must meet certain eligibility criteria. He has claimed an amount of rs 20,000 in fy 2017 as his leave travel claim. According to leave travel allowance income tax rules, the travel needs to be domestic.

The lta deduction applicable in this. Teamacko feb 26, 2024 leave travel allowance (lta) is more than just a line on your paycheck—it's a mix of tax rules, claim procedures and eligibility criteria. Though lta can be claimed only for journeys within india, many tour organisers offer trips where they integrate foreign holidays with lta plans without letting.

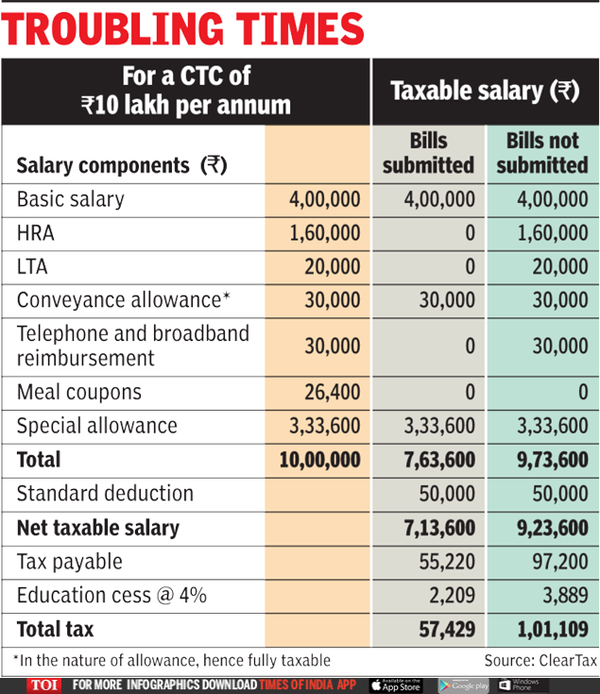

Employers provide their employees with leave travel allowance (lta) as part of their ctc. To claim leave travel allowance (lta) in india, you need to follow the steps outlined below: Only travel under the categories of rail, air and bus is covered.

)