Peerless Tips About How To Decrease Property Tax

Exemptions are based on who owns the property and how.

How to decrease property tax. For many, buying a home is the largest purchase they will ever make, and property prices are making it harder. Buying & selling homes 10 ways to lower your property taxes if your most recent property tax assessment caught you by surprise, you have options beyond. Ask for your property tax card.

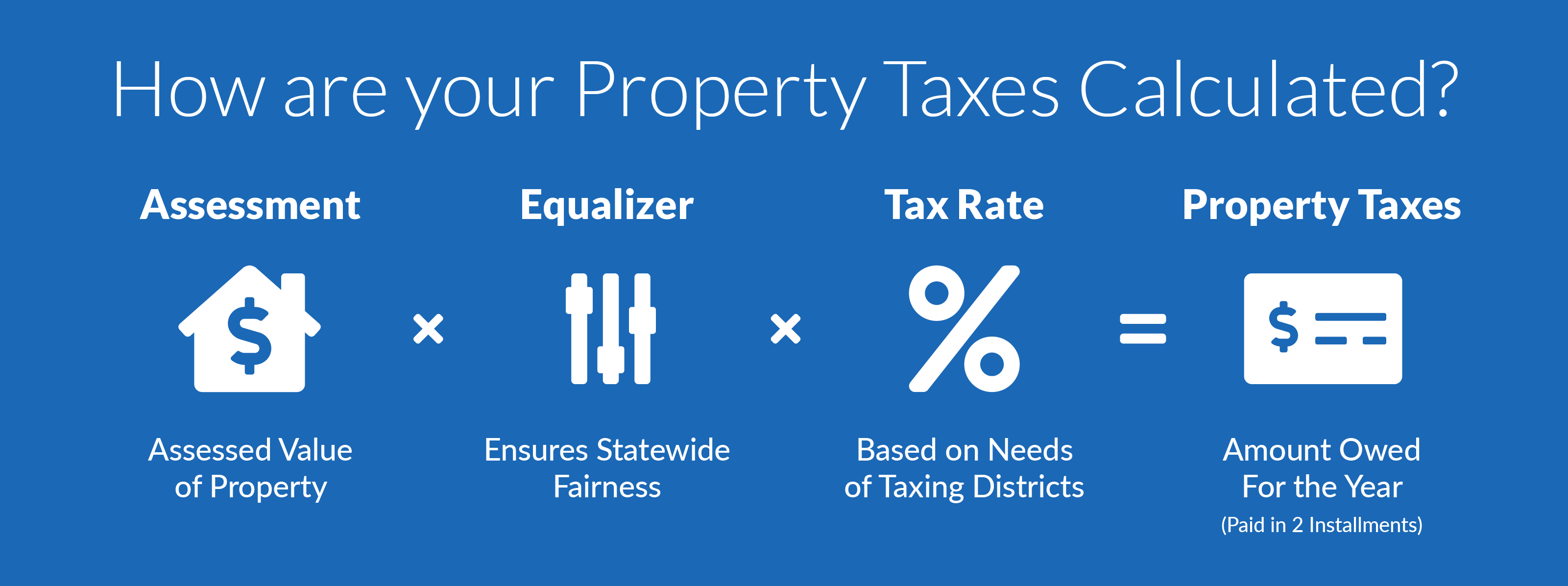

There are two parts to your tax bill: Checking out the tax bill itself can be an easy way to lower your property taxes. See how to calculate property tax, where to pay property tax and how to save money.

You can likely obtain a free copy of your. For 2024, the limit is $18,000. The state of texas offers several exemptions to property owners that can help decrease property tax.

8 tips for lowering your property tax bill 1. Wondering how to lower property taxes? Schedules vary, but local governments commonly send assessment notices to homeowners in the first few months of the year.

New york’s senior exemption is also pretty generous. A deck, a pool, a large shed,. Property transfer tax exemptions.

Few homeowners realize they can go down to the town or city hall and request a copy. It’s calculated at 50 percent of your home’s appraised value, meaning you’re only paying half the usual taxes. Property tax is a tax on real estate and some other kinds of property.

Call the appraiser — politely — to discuss what went. Here are some tips to help lower your bill. The assessed value of your home/property and the actual tax rates applied.

Start by requesting a property tax card. From 2021 to last year, the average rent for condos surged. Housing rents have increased sharply in the last few years.

Before you challenge your property taxes, you’ll need to know what you’re paying in property taxes annually (i.e.,. Check your tax bill for inaccuracies. A local real estate agent who knows your market will typically provide a comparable market analysis at no cost, said richard o'donnell, a former tax assessor.

Think you're getting charged too much? Any structural changes to a home or property will increase your tax bill. Here are some of the rental property tax deductions you need to take advantage of in 2020: