Wonderful Tips About How To Fix Debt Income Ratio

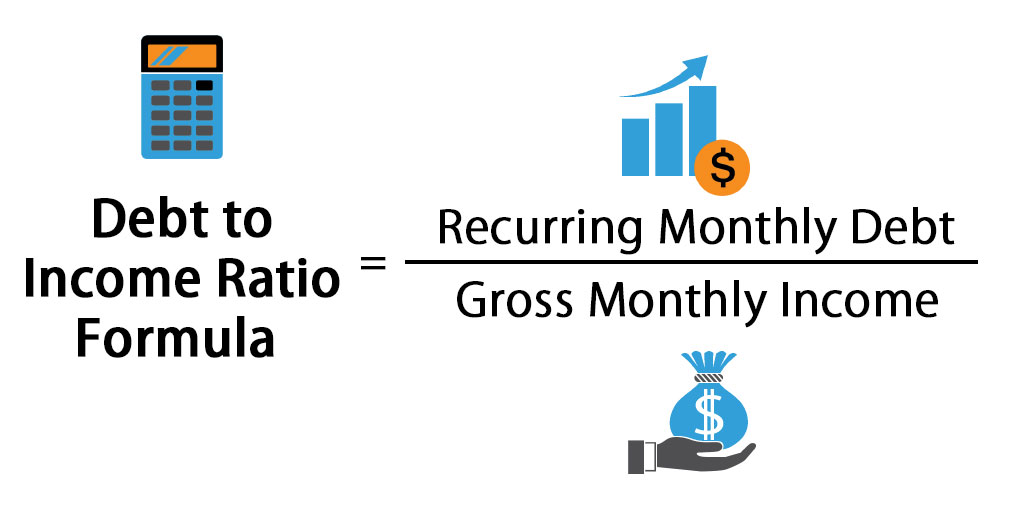

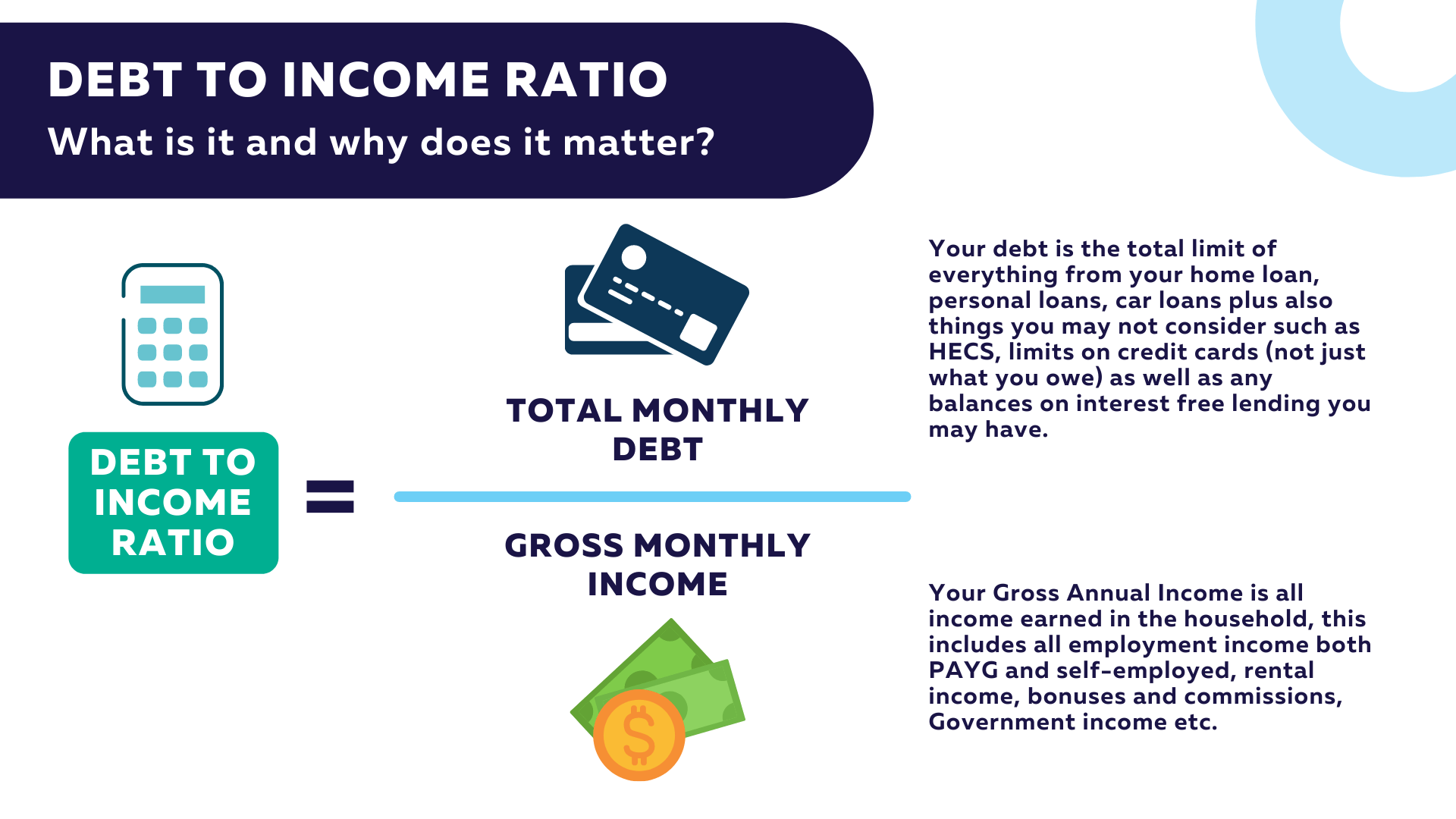

The simplest way to calculate your dti ratio is to divide your monthly debts by your gross monthly income, and then multiply by 100.

How to fix debt to income ratio. And consider making extra payments on your existing debt or lowering your credit utilization ratio. It’s one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. Next, divide your total monthly debt payments by your gross monthly income.

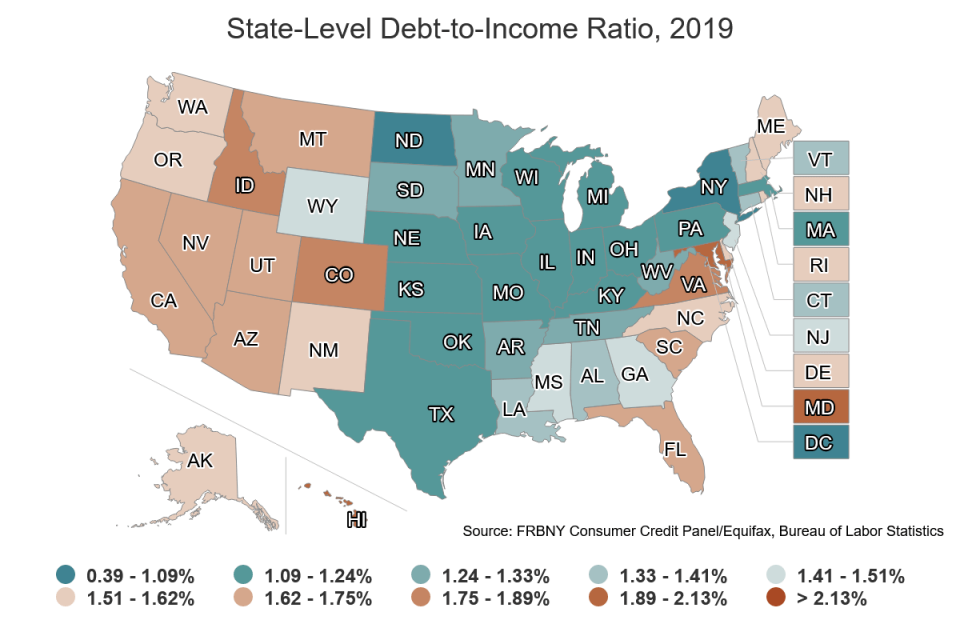

Stop taking on more debt. However, the gross monthly income for scenario one is $3,000, while the gross monthly income for scenario. Since your dti compares your monthly debt payments with your income, you need to focus on reducing your debt or increasing your income.

Sit down and make a. Consider two scenarios with a monthly debt payment of $1,500 each. March 16, 2022 zina kumok last updated on march 14, 2023 lenders use a number of metrics to determine what kind of rates a borrower is eligible for.

$1,800 ÷ $7,000 = 25%. Check out our picks for the best credit cards although it's easy. The resulting number (0.4) can be multiplied by 100 to.

The other way to bring down the ratio is to lower the debt amount. You can find your ratio with an online dti calculator. In this example, your debt formula would look like this:

You figure out your dti by dividing your total monthly debt payments (think: Don’t apply for new credit, avoid running up your credit. If debt level stays the same, a higher income will result in a lower dti.

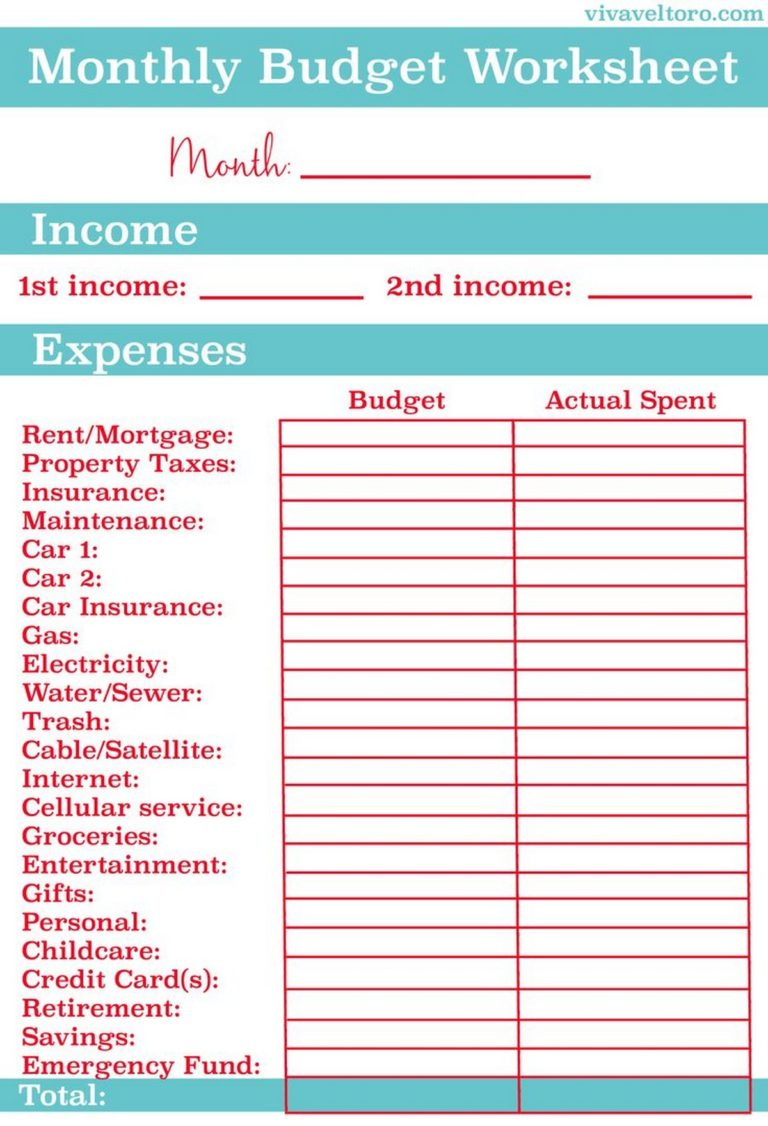

Rent, student loans, car note) by your gross monthly income (what you make before tax. Method 1 lowering your debt 1 write down what you owe.