Best Info About How To Stop Paying Pmi Insurance

Build equity to eliminate mortgage insurance.

How to stop paying pmi insurance. What is private mortgage insurance (pmi)? You can avoid pmi by making a 20% down payment. The homeowners protection act of 1998 requires your loan servicer to automatically drop pmi when your mortgage balance reaches 78% of your home’s.

A borrower who has paid enough towards the principal amount of the loan (the equivalent of that 20% down payment) can contact their lender and request that the. Best mortgage lenders. Your initial down payment.

You have two options to pay for pmi: Pay a down payment of at least 20% private mortgage insurance is typically a requirement of lenders for borrowers who need to finance at least 80% of their. The easiest, albeit slowest, way to get rid of your pmi is by making your mortgage payments on time each.

Eventually, your mortgage insurance will fall away automatically, but it's a good idea to keep track. Get the lender to pay for your mortgage insurance. The easiest way to avoid pmi is by making a down payment of 20 percent or more.

How to get rid of pmi. Request a written copy of your pmi cancellation. Fortunately, with a little advance planning and knowledge, there are ways you can avoid paying pmi.

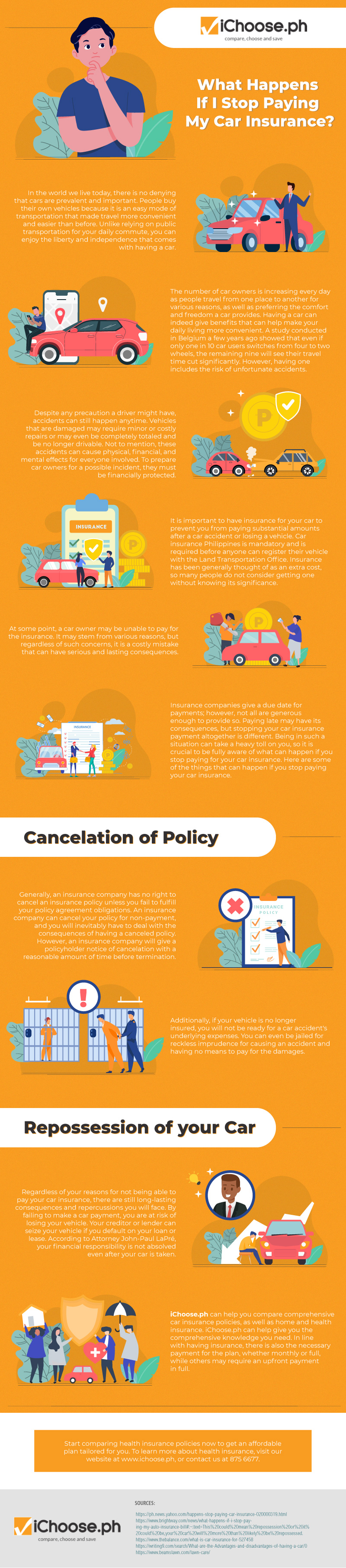

Private mortgage insurance defined and explained. In many cases, lenders roll pmi into your monthly mortgage payment. The mortgage lender covers your mortgage.

Mortgage insurance for fha loans, backed by the federal housing administration, operates a little differently. Two situations can trigger that: You can also escape from pmi earlier than you expect.

However, not all homeowners are charged for this insurance. It’s possible that your pmi payment could disappear without you taking action. If you do this, you won’t have mortgage insurance on any loan.